Learn about the latest News & Events for Fort Worth Bonds, and sign up to receive news updates.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for Fort Worth Bonds, and sign up to receive news updates.

Upcoming Events

No upcoming events. Add this issuer to your watchlist to get alerts about important updates.News & Press Releases

News

March 10, 2025

Please click the below link to view all the news articles and press releases that are available on the City of Fort Worth's government website.

News

March 4, 2025

In October 2023, City Council approved a 15% Stormwater utility fee increase for FY24, effective January 2024. Along with the Stormwater utility fee increases in FY20, FY24 and the recently approved FY25 increase, the Stormwater rate has increased seven times since the utility’s inception.

- These increases are significantly advancing the City’s efforts to keep its residents, homes and businesses safer from flood risks and reducing emergency response needs associated with flooding. Overall, however, known needs continue to exceed the program’s available resources.

What’s been accomplished so far for the capital improvement projects portion? This portion is funding the initial delivery phase for three large flood mitigation projects over a 15-year timeframe: Upper Lebow, Linwood/W. Seventh Street and the Berry/McCart area.

Over the last fiscal year, the program has advanced these projects in the following ways:

Upper Lebow

Began project development phase working on preliminary channel design, utility coordination and property acquisition.

Submitted two Federal Emergency Management Agency (FEMA) grant applications.

Submitted a state grant application to the Texas Water Development Board (TWDB) Flood Infrastructure Fund.

Began property acquisition needed to construct future improvements.

Linwood/West Seventh

Updated the existing drainage system model to better understand the current flood risk and allow for accurate evaluation and project development of flood mitigation alternatives.

Held meetings with the Tarrant Regional Water District (TRWD) to understand the impacts of potential outfall improvements to the Trinity River water levels and water quality regulations.

Evaluated potential detention and conveyance improvements to identify alternatives to advance into project development.

Berry/McCart

Began project development phase on future drainage improvements along Sandage Avenue.

Collaborated with Texas Christian University regarding potential partnership opportunities.

What’s been accomplished so far for the maintenance portion? As mentioned above, half of the FY24 Stormwater utility fee increase is going toward maintenance service level improvements. Implementation of a five-year plan for these improvements is underway.

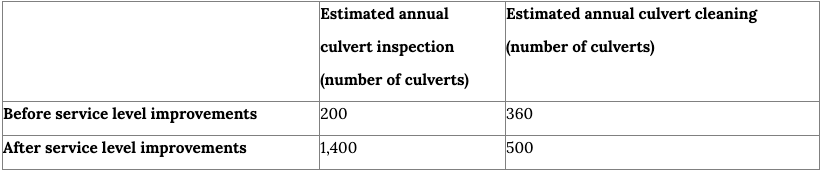

During FY24, Stormwater Field Operations kicked off a proactive citywide culvert inspection program to improve the prioritization of culvert cleaning needs. The City is responsible for approximately 4,000 culverts. This new program is the outcome of previously unidentified culvert maintenance concerns creating flood risks.

Five new staff were hired for this program in FY24 and as of December 2024, 666 culverts have now been inspected and 586 culverts have been cleaned, exceeding the City’s initial projections for the program’s first year.

The table below shows the estimated annual culvert inspection and cleaning capacity before and after the recent service level improvements.

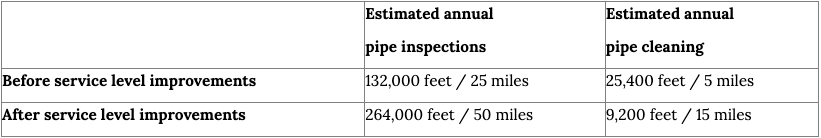

The second Stormwater maintenance program service level improvement in FY24 focused on the drainage pipe condition assessment program. A new seven-person team was created to inspect, clean and proactively plan ahead for drainage pipe condition assessments. This program accelerates the condition assessment process, enabling the City to more quickly identify and prioritize locations in need of rehabilitation, keeping the community safer from sinkholes. The work also accelerates the removal of trash and debris from the City’s drainage pipe system, which improves stormwater conveyance, mitigating the risk of flooding due to debris build-up in the storm drain system.

The table below shows the estimated annual pipe inspection and cleaning capacity before and after the recent service level improvements.

During FY24, in addition to the expanded service levels in the above two programs, Stormwater Field Operations:

- Maintained 5.8 miles of engineered channels through silt removal and re-establishing grade.

- Maintained 5.1 miles of bar ditches through regrading and silt removal to improve drainage.

- Restored 1.4 miles of engineered channels by rebuilding highly eroded channel slopes.

- Mowed 1,665 acres of right-of-way to ensure effective stormwater conveyance.

- Inspected and cleaned 6,691 of the total 30,000 inlets Citywide.

- Performed closed circuit television inspection (CCTV) condition assessment on 12.4 miles of drainage pipe to proactively identify and prioritize rehabilitation needs.

- Removed and replaced 1,807 square yards of damaged concrete storm drain infrastructure.

What’s the benefit to taxpayers? As a crucial step in safeguarding the community from future flood-related risks, the FY24 Stormwater fee increase funded multiyear phasing for three capital improvement projects, as well as enhanced service levels for maintenance of culverts and pipes. The funds from the increase were to be divided between capital flood mitigation projects and maintenance service level improvements.

Brief background: Fort Worth’s Stormwater utility launched in 2006 after five fatalities due to flooded roadways and significant flooding to 300 homes and businesses in 2004. The program’s mission: To protect people and property from harmful stormwater runoff.

To provide your feedback about the Stormwater program’s future priorities for funding and work efforts, please fill out the Stormwater Strategic Plan survey:

News

March 4, 2025

City councilmembers on Tuesday got an early look at a proposed 2026 bond program with congestion mitigation, economic development, leveraging funding opportunities and capital replacement initially becoming the focus.

On the table: City staff is considering a $800 million bond program, but requests for funding from departments far exceed that amount.

Fort Worth is on a four-year cycle for bond programs, with the most recent being approved by voters in 2022. Fort Worth continues its practice of developing the 2026 bond program with no property tax increase.

An early and evolving list of proposed projects for the 2026 bond program has been created by City staff for the purpose of gaining City Council input.

The list shows the bulk of bond funds going toward streets and mobility infrastructure improvements (59.6% of the $800 million total), followed by parks and open space improvements (23.1%). Other proposals include public safety improvements, primarily for the Fire Department and 911, 8%; animal shelter facility improvements, 7.5%; and public library improvements, 1.8%.

“In addition to this initial list of proposed projects that City staff has offered based on the available funding constraints, we know residents have interest in numerous other projects,” City Manager Jay Chapa said. “So besides the current recommended list, there is an additional menu of options that were just below the funding line that will be put forward for public comment. That list of projects totals $125 million.”

Staff-recommended projects

Streets and mobility funding

- Major roadways, $227.3 million, 10 projects.

- Neighborhood streets, $101.6 million, 15 projects.

- Intersection, $42.9 million, nine projects.

- Traffic signals, $25 million, 26 projects.

- Bridges, $25.8 million, four projects.

- Sidewalks, $19.2 million, nine projects.

- School safety, $8.3 million, six projects.

- Streetlights, $5.2 million, eight projects.

- Railroad crossings, $3 million, five projects.

- Vision Zero, a strategy to eliminate all traffic fatalities and severe injuries, $6.25 million.

- Active transportation, $8 million.

- Public art, $4.6 million.

Park and open space funding

- Community parks, $53 million, six projects.

- Community centers, $30 million to rebuild Atatiana Carr-Jefferson at Hillside Community Center.

- Fort Worth Botanic Garden, a contractual obligation, $10 million.

- Fort Worth Zoo, a contractual obligation, $4 million.

- Fort Worth Water Gardens, $10 million.

- Open space land acquisition, $25 million to be spent on land acquisitions and capital projects to prepare sites for public use.

- Aquatic facilities, $22 million, two new facilities: North Z Boaz and an aquatic and gym expansion of the YMCA.

- Golf courses, $5 million for the Meadowbrook Golf Course clubhouse and cart barn.

- Athletic complexes and infrastructure, $23 million, four projects.

- Public art, $3.1 million.

Library

$13.7 million for the expansion projects at Southwest Library, East Berry Library and Diamond Hill Library.

Public art: $300,000

Public safety

- Fire, $34.4 million to build a new Station 46 in far south Fort Worth near the Tarleton State University campus, and rebuild Station 40, originally built in 1983.

- 911 emergency communication, $28.3 million to renovate a City-owned building into a new 911 Call Center.

- Public art, $1.2 million.

Animal care

- $58.7 million for construction of a new 45,000-square-foot shelter to replace the current Silcox shelter in the southeast part of the city.

- Public art: $1.2 million.

What happens next?

Community engagement meetings will be held across the city starting this spring, and there will be online engagement tools available. Residents will be able to comment on the proposed projects as discussions progress.

This fall, City staff will finalize the project list based on public input. Final adjustments will be made to project costs, and the City Council will approve the list.

In January 2026, City Council will vote on calling the bond election. A public education meeting will be conducted in every council district ahead of the May 2026 bond election.

News

February 28, 2025

Results for America, an organization that helps government leaders use data and evidence to make better decisions, has teamed with Bloomberg Philanthropies to name Fort Worth as one of 21 new cities to be awarded the What Works Cities Certification.

The designation recognizes cities for establishing exceptional data capabilities to:

- Inform policy

- Allocate funding

- Improve services

- Evaluate programs and engage residents.

Why it matters: The What Works Cities Certification standard reflects the practices, policies and infrastructure municipalities must have in place to effectively harness data for better decision-making.

With the announcement, 104 cities in North, Central and South America have now achieved the What Works Cities Certification distinction, and 700 cities have submitted assessments since 2017.

How it affects you: Fort Worth earned a Silver certificate in part for using real-time data to bolster water management, leading to a 90% reduction in field investigations and more than $1 million in cost savings since 2019.

“I’m proud of our team for this incredible achievement and its commitment to measuring outcomes and impact in Fort Worth,” Mayor Mattie Parker said. “Decision making in a successful city requires strong data, insights and analytics, and The FWLab is moving Fort Worth forward as one of the best in the nation in this regard.”

Dig deeper: The What Works Cities Certification standard measures a city’s use of data based on 43 criteria. A city that achieves 51-67% of the 43 criteria is recognized at the Silver level of Certification, 68-84% is required to achieve Gold, and 85% or more is required to reach Platinum.

“Earning our first-ever What Works Cities certification is a major milestone in Fort Worth’s commitment to data-driven decision-making,” said Christianne Simmons, the City’s chief transformation officer. “In the FWLab, we know that collaboration and curiosity drive smarter strategies and better outcomes. This recognition highlights our progress, and we’re excited to keep advancing how we use data to serve our community.”

Program background: The What Works Cities Certification program, launched in 2017 by Bloomberg Philanthropies and led by Results for America, is the international standard of data excellence in city governance. The program is open to any city in North, Central or South America with a population of 30,000 or more.

“At a time when people are questioning the role of government, and what good government looks like, governments must be better at using data to know what is and isn’t working – and that is what the Bloomberg Philanthropies What Works Cities Certification stands for,” said Rochelle Haynes, managing director of the Bloomberg Philanthropies What Works Cities Certification. “Over 100 cities are now showing what is possible by investing the time, energy and political capital to shift the culture of how local government works.”

News

February 21, 2025

Construction to replace large cast-iron water mains starts Monday, March 3, and will impact several major downtown streets over the next two years.

Affected roadways include:

- West Lancaster Avenue.

- Summit Avenue.

- Henderson Street.

Some smaller streets will be impacted, too.

The project will involve phased street closures.

Construction over the first several months is expected to impact the following areas:

- Florence Street between West Lancaster Avenue and West 13th Street.

- West 13th Street between Florence and Henderson streets.

- West Lancaster Avenue from Florence Street to Summit Avenue.

- Collier Street between West Lancaster Avenue and Texas Street.

Why it matters: The project aims to prevent further water main breaks, like those in August 2023, by replacing nearly century-old transmission mains. Replacing major water mains in western downtown Fort Worth will help improve system reliability and public health protection.

What’s next: A preconstruction meeting is set for 9:30 a.m. Thursday, Feb. 27, in Room 2020 of Old City Hall, 200 Texas St. The meeting can also be viewed live using this Webex link.

- The discussion will cover the entire project in general but focus on the first six months, which encompasses four construction phases and the streets listed above.

- As construction progresses, meetings will occur with businesses impacted in future phases.

News

January 28, 2025

Jesus “Jay” Chapa, a respected leader with broad experience in local government, was sworn in as Fort Worth’s next city manager during a City Council ceremony today.

Chapa is no stranger to Fort Worth City Hall. During more than two decades of service, he has made a lasting impact across Fort Worth, where he has championed progress and built strong neighborhood and community relationships.

Chapa makes history as Fort Worth’s first Hispanic city manager.

A career built on innovation and impact

In more than 25 years of service, Chapa has excelled in roles ranging from deputy city manager to director of housing and economic development, implementing policies that have strengthened the City’s economy, enhanced public safety and ensured financial stability. He has led transformative projects such as the successful completion and opening of City-owned Dickies Arena, the development of Renaissance Square, and the growth of the Near Southside into a premier entertainment destination.

Chapa and his wife, Evalis, are the parents of one daughter, Emilia, who is currently a medical school student.

Chapa holds a master’s degree in public administration from the University of North Texas and a bachelor’s degree in history from Texas Tech University.

Farewell event to honor David Cooke

City Manager David Cooke is retiring in February 2025 after more than 10 years of service to the City of Fort Worth. He is the City’s longest-serving city manager.

With Chapa on board as the new city manager, Cooke’s role over the next 30 days will focus on projects he has shepherded, including the Fiscal Year 2024 budget closeout, and ensuring Chapa is fully briefed on some of the City’s most complex and pressing issues, like the transition to a Fire-based EMS service.

A community farewell to recognize Cooke’s decade-long contributions to Fort Worth is planned for 4-6 p.m. Feb. 20 at City Hall, 100 Fort Worth Trail. The public is invited to attend.

View a list of previous Fort Worth city managers, going back to 1925.

News

December 20, 2024

A ceremony this week celebrated the third phase of a four-phase plan to renovate eight Will Rogers Memorial Center livestock barns originally constructed in 1948.

Mayor Mattie Parker and Fort Worth Stock Show & Rodeo (FWSSR) officials spoke to the crowd in a ceremony that filled an additional building — the new Arena 1 that complements the renovated Sheep and Swine barns located adjacent to Dickies Arena and the National Cowgirl Museum and Hall of Fame.

“With the Stock Show only one month away, we can hardly wait to see the look on the faces of the thousands of 4-H and FFA youth when they bring their animals into these amazing buildings for competition,” said Stock Show General Manager Matt Carter. “This is truly an exciting day not only for the Fort Worth Stock Show & Rodeo, but the City of Fort Worth and the many organizations that utilize our wonderful facilities throughout the year.”

What you’ll see: Improved lighting, air ventilation, livestock washing facilities and other amenities have transformed the buildings to accommodate thousands of youth who compete in the FWSSR’s swine, sheep and goat shows. The addition of Arena 1 allows for a 41% increase in stalling space for the Stock Show’s sheep, goat and swine exhibitors.

While the sheep and swine barns were originally built for a single purpose, all three structures feature a “flat floor” design that makes them useful for a wide variety of purposes that can include banquets, trade shows, receptions, meetings, luncheons and, of course, horse shows held at WRMC during non-Stock Show months.

Why the need? Tremendous growth by equine organizations that lease WRMC has created the need for additional infrastructure for shows and competitions. The three buildings can easily be converted into horse stalls and exercise arenas for use by WRMC tenants, including the National Cutting Horse Association, American Paint Horse Association and the National Reined Cow Horse Association. An additional 320 stalls can now be made available to these organizations and others beginning in 2025.

“Without having to expand our structural footprint, these organizations now have additional stalling capacity and a new climate-controlled exercise arena for their competitors to enjoy during non-Stock Show months,” said Mayor Mattie Parker. “All these projects serve to grow the economic impact of these facilities for the City of Fort Worth, which already exceeds $217 million in direct economic activity.”

Who paid for this? Funding for the project, estimated at $40 million, was borne equally between FWSSR and the City.

More WRMC renovations are forthcoming through a longstanding public-private partnership between the Stock Show and the City.

What’s next? “We’re already working on the conceptual design of Phase Four, which will provide important upgrades to Cattle Barns 3 and 4,” said Stock Show Chairman Philip Williamson. “To date, the Stock Show and the City of Fort Worth have committed $69.24 million in improvements to these important facilities in Phases I through III. This vision has taken time and required patience, but the results are nothing short of amazing. Our decades-long public-private partnership is a shining example of what’s possible when government and the private sector come together in a common purpose.”

Shine up your boots: The Fort Worth Stock Show & Rodeo is set to “Hustle and Show,” in 2025 as it welcomes more than 13,000 youth from across Texas competing for more than $7 million in scholarships and auction receipts, along with more than 1.2 million visitors from around the world.

Encounter tantalizing food, shopping, livestock shows, live music, carnival-midway, equestrian competitions, petting zoo and more with a rodeo in Dickies Arena. Make plans today, then get ready for a legendary good time Jan. 17-Feb. 8.

News

November 13, 2024

The City Council on Tuesday approved funding $400,000 for improved Fort Worth Herd equestrian facilities in the Stockyards.

Why it matters: To assure the welfare of the Herd’s horses and livestock until new facilities can be developed as part of the second phase of development in the Stockyards, the City will amend its contract with Visit Fort Worth to fund the public-private partnership. These improvements will buy time until new facilities are constructed.

Herd history: The Fort Worth Herd produces a twice-daily longhorn cattle drive in the Fort Worth Stockyards that celebrates Fort Worth’s western heritage and lifestyle. Created in 1999, the organization today is managed as a subsidiary of Visit Fort Worth. The City funds the Herd’s $1.7 million operating budget through a contract with Visit Fort Worth. The source of City funding for the Herd is the Culture and Tourism Fund.

What’s coming: The City will fund $400,000 in improvements to the Herd’s horse barn facilities at 2500 N. Houston St. Improvements will include covered horse stalls, an operations trailer, security cameras, horse therapeutic equipment and wash rack.

The source of funding for these projects is the City’s share of profits from the operation of Cowtown Coliseum.

Separately, Friends of the Fort Worth Herd will fund $177,200 in improvements to the Herd’s livestock facilities at 129 E. Exchange St., to include onsite covered horse stalls, ventilation improvements and repairs to fences, gates and holding areas.

News

October 23, 2024

At Tuesday’s City Council Work Session, an update on the 2026 Bond Program was presented, reflecting the latest analysis of Financial Management Services on the City’s debt capacity.

Debt capacity is the maximum amount of money an organization can borrow and still be able to pay it back. In their findings, they determined that the debt capacity available for the 2026 Bond Program is approximately $800 million.

Why it matters: The 2026 Bond Program staff working group has met multiple times to review City growth trends, discuss debt capacity and anticipated bond program total resources, and to hear presentations from submitting departments. Recent meetings of the working group have focused on project scoring methodology and scoring results. Additional meetings are occurring to refine project cost estimates and to discuss project evaluation scores.

What’s new: Proposed projects for the 2026 Bond Program have been submitted by Transportation & Public Works, Park & Recreation, Fire, Police, Code Compliance, Neighborhood Services, Property Management, Library and the Open Space/Good Natured Initiative.

The total requested is $2,703,484,948 and the preliminary proposed project totals for these departments and example projects are as follows:

- Transportation & Public Works: $1,727,251,031 for arterials, neighborhood streets and intersections

- Park & Recreation: $516,500,000 for park improvements and community center renovations

- Fort Worth Fire Department: $102,874,917 for Fire Station 46, Fire Station 40 and other refurbishments

- Code Compliance: $97 million for the South Animal Shelter

- Neighborhood Services: $40 million for the Housing Affordability Bond Program

- Fort Worth Police Department: $81,664,000 for a communications center and the Seventh Patrol Division

- Fort Worth Public Library: $49,075,000 for the Far West Regional Library and Worth Heights Library

- Open Space: $22,500,000 for open space acquisitions

- Property Management: $66,620,000 for the combined West Service Center

This list does not currently include funding gaps on existing capital projects or requests from regional partners for a City bond-funded contribution for ongoing projects such as the TexRail extension, the Community Arts Center or other projects. These and other projects may emerge during the public engagement phase and the development of the bond program.

What’s next: The City will begin preparing draft recommendations for project funding, with recommendations being reprioritized and eliminated as they are determined not buildable, too costly or are no longer priorities for departments or the City. Once finalized, these staff-recommended projects will be drafted for City Council review. Once City Council approves the preliminary list, public outreach and online engagement will begin in early 2025 through the summer of 2025. In the fall of 2025, the bond project list will be finalized based on public input and with a Council approval targeted by the end of the year.

The City Council will likely set the bond election in early 2026, with public education meetings scheduled in the spring of 2026. The bond election will be held in May 2026.

News

August 31, 2024

Fort Worth is among the best real estate markets in the country, according to a new study from WalletHub.

How the rankings work: WalletHub determined the best real estate markets for their report comparing 300 cities of varied sizes using two categories: real estate market and affordability, and economic environment.

The personal finance website then assessed those categories using 17 metrics which are graded on a 100-point scale, with a score of 100 defining the healthiest market, and then determined each city’s average using the 17 metrics to calculate its overall score and used the resulting scores to rank the cities.

Among large cities, Austin (3), Fort Worth (9) and Dallas (16) finished in the top 20.

McKinney topped the overall list. Frisco finished second, but was No. 1 overall in affordability and economic environment.

News

June 26, 2024

City Council on Tuesday approved an incentive for Fort Worth Heritage LLC – a joint venture between Majestic Realty Co. and Hickman Companies – to develop Phase II of the Fort Worth Stockyards along with development partner M2G Ventures.

The site will be located between East Exchange Avenue, Stockyards Boulevard and Packers Street.

This major mixed-use development will include 300,000 square feet of new commercial space, new full-service hotels with 500 rooms, a 295-unit multifamily property, and two or more below-ground parking garages to support Cowtown Coliseum, the Fort Worth Herd and other area improvements.

“This significant investment by Fort Worth Heritage LLC, in collaboration with M2G Ventures, represents the continuation of the successful revitalization of our historic Fort Worth Stockyards, emphasizing our shared dedication to our community's economic growth and preservation of our rich heritage," said Mayor Mattie Parker. "Phase II of the Fort Worth Stockyards development promises to deliver substantial long-term value and improvements to Fort Worth's only historical entertainment district. Furthermore, this project is projected to bring over $425 million in net new taxes to our city, significantly bolstering our commercial tax base. I commend Councilman Flores for his leadership and thank all the stakeholders involved for their foresight and commitment to the continued growth and vibrancy of Fort Worth through this transformative project.”

Go deeper: The first phase of the Fort Worth Heritage project focused on Mule Alley and Hotel Drover, and was incredibly successful – increasing the area’s property value to $225 million and bringing significant new sales tax to the City of Fort Worth. Tourism in the Stockyards has also increased from 3 million to 9 million visitors annually over the past decade.

The original project – incentivized by City Council in 2014 – called for the second phase of Fort Worth Heritage to include two above-ground parking garages to help combat this challenge, but they would use a significant portion of the remaining land available for development.

By contrast, the underground garages that are part of the updated scope for Phase II will maximize the value of the site – allowing the land at ground level to be better utilized for new development that will be more consistent with the historic look and feel of the Stockyards, while also easing parking challenges in the area.

“Stockyards Heritage is proud of the successful partnerships we established ten years ago with the City of Fort Worth and Tarrant County for the preservation, adaptive reuse and further development of the Fort Worth Stockyards. Keeping the historic Stockyards vibrant, authentic, accessible and sustainable has been and remains the collective goal of all of the parties and we look forward to this next phase for the district and continuing to celebrate its rich history and spirit of the Stockyards,” said Craig Cavileer, managing partner of Stockyards Heritage Development Co.

What’s next: The developer has committed to a minimum of $630 million in overall investment, of which $472.5 million is hard construction costs, with 15% of those construction costs going towards business equity firms.

The developer will also construct the parking garages, but will convey their ownership to the City after their completion. The City would lease the garages back to the developer for 30 years, receiving the majority of the net parking profits – with a portion set aside to cover bond debt service. After 30 years, the developer will have the option to buy the garages back from the City at fair market value, or postpone that purchase by another 10 years.

Additionally, the City will provide the developer with annual performance-based grants totaling approximately $71.6 million across the incentive’s 30-year term, and would reimburse the developer up to $15 million for improvements to support the City-owned Cowtown Coliseum and the Fort Worth Herd.

However, much of this incentive will be paid for through the net proceeds from the parking garages – bringing the total public investment in the project to $145,669,450. This amount will be funded from new incremental taxes resulting from the project itself.

“The public-private partnership between the City of Fort Worth and Stockyards Heritage for Phase 2 is both welcomed and exciting,” said District 2 Councilmember Carlos Flores. “Ten years ago, there were many questions and concerns when Phase I was announced yet today, it’s been a resounding success. That success validates the vision for the Stockyards then, now, and for the future. Majestic Reality and the Hickman family are valued partners and we look forward to the continued improvement, redevelopment and preservation of our Historic Stockyards.”

Bottom line: Ultimately, the second phase of the Fort Worth Stockyards is expected to bring $425,301,534 in net new taxes to the city. When combined with the parking profits and the eventual sale of the parking garages, the project will ultimately bring $844,997,159 in total net value to Fort Worth’s commercial tax base, while improving parking capacity in one of the most popular entertainment districts.

“This project is an outstanding example of the kinds of public-private partnerships that Fort Worth is known for,” said Michael Hennig, economic development manager at the City of Fort Worth. “We look forward to continuing this collaboration with our partners at Fort Worth Heritage to showcase the Western spirit of the Historic Stockyards that makes our city so unique.”

News

May 16, 2024

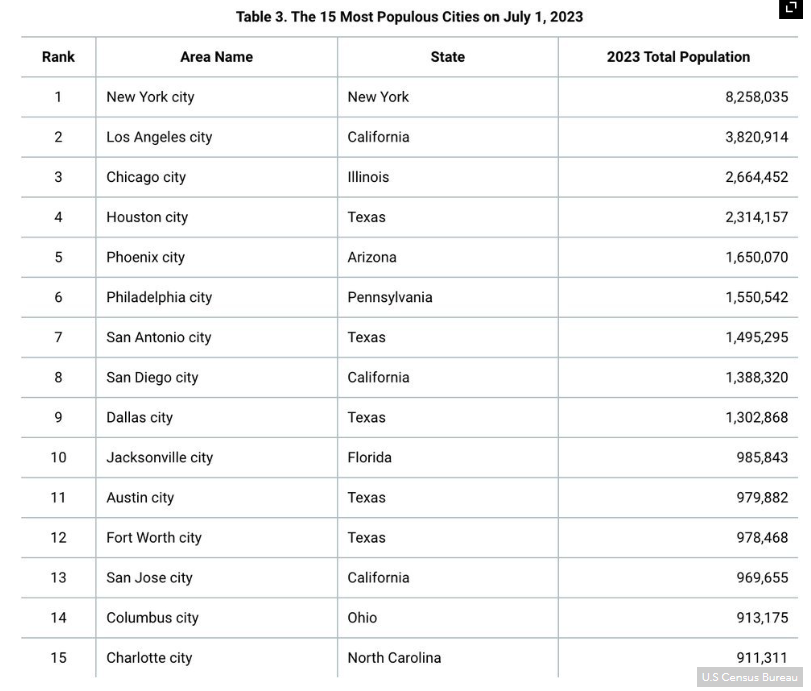

The city regains its status as the 12th-largest city in the America. Austin, that's us right on your rear.

Fort Worth, with a population of 978,468, has regained its status as the 12th-largest city in the U.S., moving past San Jose, California, according to estimates released on Thursday by the U.S. Census Bureau.

The city is a mere 1,400 behind No. 11 Austin and 7,300 behind No. 10 Jacksonville, Florida.

Dallas, at 1,302,868, is the ninth-largest city in America. Big D added 5,500 people, a 0.42% increase.

Fort Worth enjoyed the second-largest increase for cities with populations more than 20,000 between July 1, 2022, and July 1, 2023, gaining 21,365. San Antonio, population 1,495,295, experienced the largest increase at 21,970.

Of the top 10 cities with the largest increases, five were in Texas, including Houston, Georgetown, and Celina. All 10 were in the South, including Jacksonville. Moreover, eight of the 15 fastest-growing cities were in Texas, including five in North Texas.

“Thirteen of the 15 fastest-growing cities were in the South, with eight in Texas alone,” said Crystal Delbé, a statistician in the Census Bureau’s Population Division.

Celina’s population grew by 26.6%, more than 53 times that of the nation’s growth rate of 0.5%.

Texas’ 2023 estimates stood at 30.5 million, up almost 475,000 people from 2022.

In 2020, census analysts projected Fort Worth to reach a population of 1 million by 2028. Since 2010, the city has added more than 237,000 people.

In Fort Worth, it's not just the population that is growing. New projects the City Council has incentivized are expected to add 4,000 jobs this year.

“Our success as a city is contingent upon our commitment to quality of life policies and investments,” Mayor Mattie Parker said last week at the United States Conference of Mayors meeting in Fort Worth. “People are quite literally voting with their feet. When people could live anywhere, they’re choosing to live in Fort Worth.”

Amid notable examples of growth in the South, other fast-growing cities saw their rates of population change slow. For example, population growth in Georgetown slowed by more than one-fourth its population growth in 2022, from 14.4% to 10.6%.

New York (8.3 million) remained the most populous city in the U.S., followed by Los Angeles (3.8 million), Chicago (2.6 million), Houston (2.3 million), and Phoenix (1.6 million).

Los Angeles lost only 1,800 people last year, following a decline in the 2020s of almost 78,000 residents. Chicago, which has lost almost 82,000 people this decade, only had a population drop of 8,200 residents last year.

And San Francisco, which has lost a greater share of residents this decade than any other big city — almost 7.5% — actually grew by more than 1,200 residents last year.

For the first time in 66 years, Detroit grew in population, a fact that Mayor Mike Duggan said was cause for "a day of celebration" for Michigan's largest city.

Detroit gained 1,852 people, putting the city's population at 633,218. It marks the first time the city has gained population year over year since 1957.

The nation’s housing stock grew by about 1.6 million units between July 1, 2022, and July 1, 2023, reaching a total of 145.3 million. The 1.1% increase was nearly the same as the 1.2% increase between 2021 and 2022.

Tarrant County was among the top 15 in the country with 17,194 housing units added. Denton and Dallas, 14,296 and 13,644, respectively, earned spots, as did Collin County, which had the fifth most added in the country at 18,000.

California had the largest number of housing units (14.8 million), followed by Texas (12.4 million) and Florida (10.5 million), while Wyoming (280,000) and Alaska (330,000) had the fewest housing units.

News

May 19, 2023

Fort Worth’s population is inching closer to one million after adding more residents than any other city in the country in 2022, according to new Census data.

The city welcomed 19,170 more people between July 1, 2021, and July 1, 2022. This brings Fort Worth’s total population for 2022 to 956,709, according to the Census figures released May 18.

While Fort Worth’s growth is notable, it has been keeping pace with its past numbers, said Eric Fladager, assistant director of planning and data analytics for the city.

“If you go back and look at the last 20 years, Fort Worth is either at or near the top of the fastest-growing markets in the United States,” he said. “This is not out of line with what we would expect.”

When it comes to quantifying the increase, Fladager notes that it equates to around or a little over 50 people a day.

“It’s kind of like a busload of folks arriving every day,” he said.

Fort Worth remains the 13th largest city in the country and is the fifth largest in Texas, behind Houston, San Antonio, Dallas and Austin.

New York, despite a population decrease, remains the nation’s largest city No. 1 (8.3 million) and Los Angeles is No. 2.

Fladager estimates Fort Worth will hit a population of 1 million by 2027 or 2028 if the numbers stay consistent.

“Many of the cities that are on the top list have actually lost population since 2020. So there’s not an even playing field in terms of how growth happens or does not happen,” he said.

Texas was also the only state with more than three cities on both the 15 fastest-growing large cities and towns lists in raw numbers and percentage change.

Georgetown, north of Austin, was the nation’s fastest-growing city over 50,000 in percentage change, at 14.4 %. Other Texas cities among the top 15 on that list include Kyle, Leander, Little Elm, Conroe and New Braunfels.

While population growth was notable in the major urban areas in Texas, some of the smaller cities on the edge of big metros are also growing very quickly, said Kyle Walker, associate professor of geography and director of the Center for Urban Studies at Texas Christian University.

“You see DFW and Fort Worth being attractive places to move to in part because housing costs are comparatively low, and economic opportunities are certainly available. We have a lot of amenities,” Walker said. “There’s room to grow… It is difficult to build a major city that is connected to open space. It’s rare for a city to be able to do both of those things at once.”

Fort Worth is in the process of working on its Comprehensive Plan, which lays out long-term planning strategies for the city over the next 20 years. Those numbers are valuable in that planning process.

The increasing growth rate makes this process even more important, Fladager said.

“It’s important for us, in large part based on that growth, based on the changes in economic opportunities, based on the city’s focus and the city council’s very clear focus on the quality of life,” Fladager said. “Making Fort Worth really one of the greatest cities in the country and one that folks want to come to.”

Sandra Sadek is a Report for America corps member, covering growth for the Fort Worth Report. You can contact her at sandra.sadek@fortworthreport.org or on Twitter at @ssadek19.

News

March 1, 2023

As one of the largest and fastest-growing cities in the country, Fort Worth boasts many unique characteristics that add up to an especially fertile ground in which businesses can thrive. The low cost of real estate, an abundance of land available for development, solid foundations in various key industries and a diverse talent pool all play a role in Fort Worth's economic success.

Reclaiming Fort Worth’s riverfront

One major project in the works is Panther Island, an ambitious development with huge potential. Brought about by the need for improved flood control along the Trinity River, the project will ultimately create more than 300 acres of urban waterfront property in the heart of the city. The $1.1 billion district will create additional opportunities for growth in downtown Fort Worth and its surrounding neighborhoods.

Companies choose North Texas because they want a business-friendly environment that is rich in options, incentives and growth opportunities. In keeping pace with the region’s thriving industries and corporate relocations, Panther Island will help sustain that momentum for Fort Worth, bringing even more leading companies and top-tier businesses to Fort Worth, while driving additional development – and investment – in the region.

Creating new districts around education and innovation

The Texas A&M University System is expanding in downtown Fort Worth. Building off the nationally ranked Texas A&M University School of Law, this initiative will create a three-building, mixed-use campus and research center for higher education, legal studies, corporate and academic research partnerships, and new-economy innovation. Local industry leaders like Alcon, AT&T, Lockheed Martin and Bell are discussing ways to leverage the university’s Tier 1 presence and the workforce it will cultivate.

Additionally, Texas Christian University is building a new medical campus for the Anne Marion Burnett School of Medicine, one of the newest and most innovative medical schools in the country. The campus is in Fort Worth's recently formalized Medical Innovation District, which is working to become the “most livable medical district in the U.S.,” thanks to the combined efforts of academic institutions like TCU and University of North Texas (UNT) Health Science Center at Fort Worth, academic medical centers like UT Southwestern, local biotech incubators like TechFW, Fort Worth’s major hospitals and dozens of independent clinics.

The goal is to create a multidisciplinary environment that encourages public-private partnerships, collaboration, and engagement between Fort Worth’s community of biotech and pharmaceutical entrepreneurs and its medical sector.

City of Fort Worth Economic Development Director Robert Sturns said, “It’s exciting to see Fort Worth’s colleges and universities align with target industries that have historically been critical to our city’s economic success. The expansion of these institutions will have significant, long-term impacts for our workforce and talent pipelines.”

Innovating across all sectors

Collaboration across industries and within the region has been instrumental to the continued success in North Texas. A great example of that cooperation is AllianceTexas, Hillwood’s 27,000-acre, master-planned, mixed-use community in north Fort Worth. Hailed as one of the state’s most formidable economic engines, AllianceTexas has generated more than $100 billion in regional economic impact.

AllianceTexas is also home to the Mobility Innovation Zone (MIZ), a unique testing ecosystem that combines strategic partnerships and infrastructure to allow pioneering mobility companies to test, scale and commercialize their innovations. The MIZ served as the testing location for Wing, Alphabet's revolutionary commercial drone delivery service.

In 2022, autonomous delivery company Clevon opened its U.S. headquarters in AllianceTexas. In early December Clevon completed its first U.S. delivery in a real-world setting with the CLEVON 1, the company’s eco-friendly autonomous delivery vehicle.

The MIZ is anchored by Alliance Airport, the world’s first dedicated industrial airport. Its presence is spurring innovative solutions throughout the supply chain and attracting leading companies focused on the autonomous and automated movement of goods. In the last five years, Alliance Airport has experienced incredible growth and demand, increasing cargo transportation volume by 43% year over year, earning its new ranking by the Federal Aviation Administration as one of the top 20 U.S. cargo airports.

With a rich legacy of the entrepreneurial spirit and a forward-looking approach to talent and industry, Fort Worth is where opportunity begins.

To learn more about economic development in Fort Worth and how the city capitalizes on its central location and space to leverage opportunities for the future, visit itbeginsinfortworth.com.

News

February 9, 2023

Fort Worth’s convention center expansion has had its share of setbacks.

City leaders began discussing the project over a decade ago. Under the original plans, phase one of the expanded Fort Worth Convention Center should be nearing completion this year. But then COVID-19 came and Fort Worth’s culture and tourism fund — the source of the project’s funding – took a big hit. Tourism revenue decreased by about $11 million between 2019 and 2020.

About $52 million in federal funds restarted the project. The money comes from the American Rescue Plan Act, a $1.9 trillion law designed to help the country recover from the pandemic. The infusion of federal funds will pay for over half of the first part of construction.

Mike Crum, director of Fort Worth’s public events department, started working for Fort Worth Feb. 3, 2020 – about a month before the pandemic began to emerge in the U.S.. His first meeting was with the advisory committee for the convention center expansion.

“We had one meeting,” Crum said. “Then we had to shelve the whole thing.”

The delay and other factors, such as the planned realignment of Commerce Street and inflation, ballooned the estimated cost of the project by $324 million, almost double the estimate in 2019.

The city is moving forward, though, because Fort Worth is in desperate need of a better convention center and expanded hotel options downtown, according to Bob Jameson, president and CEO of Visit Fort Worth.

The Fort Worth Convention Center currently struggles to compete with other cities for regional and national conferences. The city in phase two will demolish the arena attached to the convention center and expand exhibit halls, ballrooms and meeting spaces to make the city more competitive.

With federal dollars immediately available to the project, the city is preparing to finalize its plan to finance the rest of the project through debt.

“We would sell $43 million in debt this May to flesh out the budget and that’ll permit us to move forward,” Crum said.

How do cities take on debt?

Cities can take on different kinds of debt depending on its purpose, according to the Texas Comptroller. Some require voter approval, such as bond debt. Other types of debt such as certificates of obligation allow the city to issue debt quickly without voter approval. Both types of debt allow cities to pay for capital projects in the long term.

The role of hotel occupancy taxes

Cities often use debt to fund major construction projects through bond elections — voters approved a $560 million bond in May 2022. And the city paid for its portion of Dickies Arena’s cost through Special Tax Revenue Bonds — a type of debt voters approved in Nov. 2014.

However, in both of those cases voters had the opportunity to vote on whether to approve the debt. That’s not the case for the convention center, at least in the first part of the project.

Hotel occupancy tax is the biggest contributor to the culture and tourism fund along with revenue collected from Dallas-Fort Worth Airport, hotel taxes paid around the Cultural District and Stockyards and, finally, venue taxes – such as for tickets and parking — which is the same revenue approved by voters in 2014 to fund construction of Dickies Arena.

All of those taxes don’t need voter approval unless they have to be increased, Crum said. That could be the case for the second part of the project, which the city expects will cost $606 million.

“We’ve not made any decisions or any recommendations, but, you know, we could bump the (hotel) occupancy tax another two percentage points,” Crum said.

City leaders will discuss any tax increases to pay for phase two of the project in October. Project leaders are continuously working on cost estimates for the second part of the project of the project, according to a presentation to Fort Worth’s City Council in January.

Hotel occupancy tax is the tax visitors to the city pay when they book hotel rooms. That tax is the primary source of revenue to the cultural and tourism fund, which finances Visit Fort Worth and partially finances Dickies Arena and Will Rogers Memorial Center, Jameson said.

The city also could sell the naming rights to the convention center, an emerging trend – such as Dickies Arena and the American Airlines Center in Dallas – that has become more lucrative in the past decade, Crum said.

City staff will give a presentation about the $43 million in debt it plans to take on this month, and is set to officially sell the debt in May.

The city also has revenue estimates for the culture and tourism funds for the next three years — funds the city will use to chip away at the debt it plans to take on for the project. The city expects to earn about $272.2 million by 2026, with revenue estimates increasing at a pace of about $3 million per year.

About $3.9 million of these funds will be used to pay down the debt for the first phase of the convention center every year for 30 years.

Dallas is also giving its convention center a makeover

Fort Worth isn’t the only convention center being redesigned that is coping with rising construction costs. Dallas recently unveiled a master plan for its new Kay Bailey Hutchison Convention Center with a new estimated price tag of $3 billion.

Voters in Dallas approved a 2% increase in the city’s hotel occupancy tax in November to fund the convention center project and renovations in Fair Park.

While Fort Worth’s expansion won’t match the total rebuild Dallas is planning, it will allow the city to be more competitive in the race to attract regional meetings and compete for conventions on the national level, Crum said.

Texas A&M University’s downtown expansion presents opportunity for redesign

Despite Fort Worth’s pandemic set backs thus far, in 2021 the project received a dose of synergy from Texas A&M University’s planned downtown campus.

The project’s advisory committee made adjustments to the project’s plan based on Texas A&M’s planned development. The city will rebuild the southeast entrance to the Fort Worth Convention Center, adding about $10 million to the phase 1 budget, in response to Texas A&M’s investment in downtown, Crum said.

“From the beginning, city and county officials have talked to us about the two projects complementing one another. We see it that way, too,” Laylan Copelin, a spokesperson for Texas A&M University, said in a statement.

The downtown campus will face the convention center, the water gardens and a new convention center hotel. Urban designers are already at work planning the design of shared spaces such as roads, sidewalks and public spaces.

“All of these pieces need to be thought of together and that is very top of mind in every conversation I’ve been a part of,” Andy Taft, president of Downtown Fort Worth Inc. , said.

Texas A&M also will invite large groups to Fort Worth for academic meetings, Taft said. That will create more room nights in the hotels surrounding the campus and convention center.

“There’s no question, those are two great synergies,” Taft said.

The convention center will have an economic impact on Fort Worth beyond the hotel rooms it will help fill, Jameson said. Tourism activity is expected to double as a result of the convention center’s expansion.

Visitors to the city spend more on food and beverage than they do on hotel rooms, all of that sales tax revenue flows into the city’s general fund to offset the costs of city services for residents, Jameson said.

“It’s a powerful segment of the Fort Worth economy and there’s an opportunity for it to grow and contribute more,” Jameson said.

News

January 10, 2023

City leaders approved a multi-step financing plan to make dreams of a $350 million downtown Texas A&M University campus a reality for Fort Worth on Tuesday night.

“I think it’s going to bring such a huge impact to an area of downtown that we’re trying to really revitalize,” District 9 council member Elizabeth Beck said. “I think not just for downtown and District 9 but the city of Fort Worth it’s going to be a step in the right direction”

Texas A&M, which currently owns the land downtown, will enter into a ground lease with the city. The city will then develop property on the land alongside a third-party developer, divide it into condominium units, and sublease a portion of those units back to the university until its debts to the city are repaid.

The agreement allows the city to finance the capital project without a general obligation bond, which would require approval from voters before it’s issued. At the end of the lease term, when the debt is fully repaid, the condominium units owned by the city will be transferred to the university.

A&M will also have a purchase option and right of first refusal for the non-academic units owned by the third-party developer.

Under the terms of the agreement, the city will establish a local government corporation, which will have a board of directors made up of council members, to accelerate development of two buildings: the research and innovation building and the gateway conference center building. A third, the law and education building, will be designed and constructed by A&M exclusively.

Establishing a local government corporation allows the city to issue debt and fund the purchase of the condominium ownership interest for A&M’s future units. It also erases the need for a bond election, like the $560 million bond package approved by voters in 2022. City and university officials previously told the Report that Texas A&M will guarantee any bonds issued by the city for the project, meaning taxpayers won’t be impacted.

What powers does the local government corporation have?

The local government corporation may:

- Acquire and hold title to real property and interests in real property.

- Accept funds and property appropriated by the city.

- Accept donations of funds, services, and things of value.

- Issue bonds, notes, and other debt obligations as necessary for the accomplishment of the governmental purpose stated above, provided that the corporation shall not incur debt without approval by City Council

A request for proposals has been issued to find a suitable developer to lead the design, construction and financing of the buildings and an accompanying campus plaza. That developer will control the non-academic units of the buildings. The city anticipates selecting a developer by February, according to a report to council members.

The city will lease its portions of the buildings to A&M for academic and university purposes. The lease payments will cover all debt service and other pre-approved expenses associated with the development of the parts of campus used exclusively by A&M, according to the report presented to council.

Texas A&M officials anticipate the partnership will shorten the timetable on design and construction of the campus from over 10 years to five to six years. The university previously outlined its intentions to partner with several major corporations, including Alcon, AT&T and Lockheed Martin, as well as Tarleton State University, at the new campus.

The next step for the city and A&M is signing a master development agreement and ground leases, after the two entities have negotiated and agreed upon more specific lease terms. Those leases will have to be approved by the system’s Board of Regents.

Fort Worth City Council boasts two A&M alums in Beck and District 3’s Michael Crain, and both shared their personal excitement about the project.

“As a Texas A&M School of Law alum, it’s got even more excitement for me, because of my connection to the school,” Beck said.

“Gig Em’,” Crain said with a grin as the final vote was taken.

At the Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our editorial independence policy here.

News

December 6, 2022

Fort Worth’s net sales tax collections in September totaled $20,615,715, up from September 2021 by 10%.

The state saw a net collection increase of 11.9% compared to the same month last year.

The city’s General Fund net sales tax collections year to date are 119% to budget, and at 116.1% compared to the year-to-date total last year. The city’s Crime Control and Prevention District Fund sales tax collections for June are 118.6% to budget and 116.3% of the year-to-date total for the same month last year.

The City anticipates collecting $204,500,000 by fiscal year end, an increase of $21.6 million, or 11.8%, over the fiscal year 2022 adopted budget. This represents an 8.7% increase over fiscal year 2021 actual collections, and a 20.3% increase over the fiscal year 2021 adopted budget.

Sales tax revenue represents 22% of the city’s General Fund budget. This is the second largest revenue source, with property taxes being the largest.

For the Crime Control and Prevention District, sales tax revenue represents the largest revenue source.

News

October 10, 2022

While there is plenty of recession talk in the air, Todd Burnette, managing director of JLL Fort Worth, doesn’t see it for Tarrant County or for North Texas.

“We’re in the early phases of what I think is going to be tremendous growth in Fort Worth,” he said.

Burnette has plenty of experience with Fort Worth. He came to the city in 1986, shortly after he graduated from SMU. He is now managing director of JLL’s Fort Worth office, which he started in 2002. JLL is a global real estate services company with more than 90,000 employees.

Along the way, he has represented some of the area’s largest names, including BNSF, Lockheed Martin, Bell, Tarrant County, Frost Bank and the city of Fort Worth and negotiated more than 37 million square feet of commercial property leases, acquisitions, and dispositions.

Much of the growth and economic development he sees coming will take place in downtown Fort Worth, Burnette says.

“We’re not in the residential downtown market, but it’s starting to explode, and that will have a big impact on the office market,” he said.

Several more downtown projects are set to be announced over the next six months, and those will drive more and more people to the central city, Burnette said.

“It’s already a really cool place, but it’s becoming cooler with all these new apartments and condos that are being built downtown,” he said.

Companies are looking for ways to attract new young talent, and those young adults living in downtown Fort Worth are going to attract companies seeking a workforce.

“That, in turn, is going to open up the office market downtown,” he said.

The last Fort Worth office tower to be built in downtown was the Frost Tower in 2018. Burnette expects that to change.

“I think you’re going to see an office announcement because that’s what these companies want. They want to attract young, talented employees, and they’re going to be downtown or nearby,” he said.

Burnette compared the area to Uptown in Dallas, which he said is one of the hottest areas in the country right now.

“What they have done is attract all these financial institutions, and they’re vying for the same kind of people,” he said. “Those employees want a really cool space with some great amenities in a fairly walkable-type environment. I think that’s what you’re going to see here.”

Part of the reason for the strong market conditions in Fort Worth is the city is now attracting money from outside the area.

When he came to the city in 1986, Fort Worth was still more of a West Texas town with little money coming from outside the area for large investments, Burnette said.

“It has changed dramatically over the last five years or so,” he said. “Fort Worth is a true gem and the institutional money that’s out there is looking at projects here. That wasn’t the case just a few years ago.”

Pier 1 building, the future Fort Worth City Hall (Photo courtesy of city of Fort Worth)

Burnette recalled when he first came to the city, the downtown economy was dominated by three companies: Pier 1, RadioShack and XTO.

“Today all of those are gone, which is unreal,” he said.

Fort Worth lost retailers Pier 1 and RadioShack to changes in market conditions, while XTO was acquired in 2009 by ExxonMobil Corp., which eventually vacated the six buildings it occupied and owned downtown.

Many were fearful that that excess office capacity would hurt the area’s economy, but Burnette noted that all the buildings redeveloped into either hospitality or residential properties. JLL handled the transactions for ExxonMobil.

Burnette expects those trends to continue with the 300,347- square-foot former Oncor Building in downtown, which is currently for sale.

“Like the former XTO buildings, I expect that will become some residential or hospitality-type project,” he said.

JLL is marketing that project.

Burnette isn’t the only one touting the strength of the office market in Dallas-Fort Worth.

Andrew Matheny, research director for real estate services firm Transwestern in Dallas, said the area’s employment growth is likely to keep the economy strong here even as a potential recession looms .

“Employment may grow by 11% or more over the next 10 years, creating supportive conditions for office demand over the long term,” he said.

Burnette and JLL have been involved in the Pier 1 Tower for years, first helping Pier 1 sell it to Chesapeake Energy for $108 million in 2008. The building was then sold back to Pier 1 in 2014 and then to Hertz.

“When Pier 1 went under, we went to the city and said, ‘You need this much space and you can get this for pennies on the dollar compared to building something,’” Burnette said.

The city purchased the building in 2021 for about $40 million and will spend another $50 million or so to renovate it.

“It may be the nicest city hall in the country when it opens for half the money,” he said.

Burnette’s positive outlook is bolstered by data from JLL. In a recent report on Fort Worth office space for the third quarter of 2022, JLL notes that office activity around the city is strong, with Class A construction accounting for 88.7% of the development activity, with only downtown and the HEB/East Fort Worth submarkets without any Class A developments currently. There were 538,295 square feet of office space under construction in Fort Worth during the quarter, according to JLL.

Other analysts are seeing similar strength in the Class A office market in the Dallas-Fort Worth area.

“Looking at absorption rates this quarter, it is clear that tenants prefer high quality Class A office spaces,” said Matt Schendle, vice chairman of Cushman & Wakefield’s Dallas office, commenting on the company’s recent third quarter office report. “Companies want to incentivize the in-office experience for their employees and quality office buildings continue to be the linchpin for this strategy.”

While Burnette sees downtown’s office market as strong, he is particularly bullish on the southern end of downtown where Texas A&M has announced plans for an estimated $350 million campus and expansion of the current law school. Along with the new campus, the Omni Hotel has announced plans for a $200 million expansion and the Fort Worth Convention Center is set for a major upgrade.

“I don’t think you’ll recognize the southern end of downtown in a few years,” Burnette said.

Burnette said that, along with downtown, other areas of Fort Worth are seeing good office activity, such as southwest Fort Worth with Clearfork and Waterside and, to the north, the Stockyards.

“Twenty years ago Clearfork was just a field,” he said. “Now you have all this residential going in there, some high-end retail and the office space is basically full.”

Burnette expects the next big class AA-type office building to be announced for that area.

The Stockyards area has proven it can be a player in the office market as well, Burnette said.

“When Simpli.fi announced in 2018 they were moving their offices there, many people didn’t see how it made sense,” he said. “Now people can see how smart that was. The Stockyards has proven to be a great place for a workplace.”

Simpli.fi, a technology company, leased 77,000 square feet of office space in the Horse and Mule Barn building in a deal negotiated by JLL.

The biggest limit on the growth of the downtown Fort Worth market is the lack of properties with 300,000 square feet of contiguous space, Burnette said.

“We need more space, and I think it will come,” he said.

But, above all, he doesn’t see Fort Worth or north Texas experiencing an economic slowdown.

“There’s a lot of really good signs, and it doesn’t sound to me like a recession or a real estate market that is in trouble,” he said.

Bob Francis is business editor for the Fort Worth Report. Contact him at bob.francis@fortworthreport.org. At the Fort Worth Report, news decisions are made independently of our board members and financial supporters. Read more about our editorial independence policy here.

News

June 7, 2022

Fort Worth’s net sales tax collections in March totaled $20,415,932, up from March 2021 by 9.7%.

For March of 2022, the year over year comparison by month reflects lower percentage growth as a result of being free from restrictions for a full year. Gov. Abbott fully lifted COVID-19 restrictions in March 2021.

The state saw a net collection increase of 12.8% compared to the same month last year.

The city’s General Fund net sales tax collections for March are 115.5% to budget, and at 117.9% compared to the same month last year. The city’s Crime Control and Prevention District Fund sales tax collections for February are 115.2% to budget and 118.6% to the same month last year.

Sales tax revenue represents 22% of the city’s General Fund budget. This is the second largest revenue source, with property taxes being the largest.

For the Crime Control and Prevention District, sales tax revenue represents the largest revenue source.

News

January 27, 2022

With the announcement Wednesday of more than $400 million in federal funding approved for Panther Island, Fort Worth’s long-awaited redevelopment project along the Trinity River is taking a significant leap toward becoming a reality.

For decades, Panther Island has been a pie in the sky — a river-walk dream that never quite seemed destined to secure enough funding to break ground. But now, with federal money en route, that could change.

So what is Panther Island? Here’s everything you need to know about the project that has intrigued, and irritated, Fort Worthians for years.

What is Panther Island?

Panther Island is a planned development and flood control project on the Trinity River in Fort Worth, just north of downtown and south of the Stockyards. There are several access points to the planned project area; from downtown, North Main Street takes you over the Trinity River and onto the future Panther Island.

It’s overseen by the Trinity River Vision Authority, which is an appointed board that includes members from the city of Fort Worth, Tarrant County and the Tarrant Regional Water District.

As envisioned, the project would involve the digging of a new, 1.5-mile river channel to connect a U-shaped section of the Trinity River north of downtown Fort Worth. The new channel would create two man-made islands that are collectively referred to as “Panther Island.” Construction crews would also dig a network of smaller channels within Panther Island to create more waterfront property.

Although the designs for the project often focus on the economic development, officials have billed Panther Island as a flood-control project that would protect a couple thousand acres of property from potential disaster. Officially, the project is referred to as the Panther Island/Central City project, to encompass both the development and flood-control aspects.

What's on the land now?

The entire project is about 800 acres; about half of that is on what will be two new islands. Many of the properties there are unused or vacant, previously used as manufacturing or industrial facilities.

The area is also home to a structure that was originally built as a Ku Klux Klan meeting hall, which is the only purpose-built Klan hall still standing in the country. That building, which was later purchased by a pecan company and then sat vacant for many years, was recently sold to a local arts coalition that hopes to reclaim the building.

Other notable properties on Panther Island include:

- Coyote Drive-In Theater

- Panther Island Ice rink, which is next door to the theater

- The former LaGrave Field, a now-abandoned baseball stadium that used to house the minor league Fort Worth Cats

- Panther Island Brewing, which opened in 2014.

And, marking the area’s first new major development, new apartment complex Encore Panther Island opened in December.

What Will Panther Island look like?

When explaining the intended look and feel of Panther Island, officials often refer to the San Antonio River Walk, which is a pedestrian-friendly development lining the San Antonio River with restaurants and stores.

Officials envision Panther Island as a highly dense development of restaurants and shopping, as well as housing for about 10,000 residents. The new bypass channel would create an urban lake designed for recreation.

The visioning for what is now called Panther Island began about 20 years ago, as a plan to construct a bustling urban area north of downtown Fort Worth. At the time, the project was referred to as Trinity Uptown.

Panther Island Project

A 1.5-mile channel will connect sections of the Clear and West Forks of the Trinity River north of downtown Fort Worth to create Panther Island, which will actually have two islands. As it was conceived more than 20 years ago, Panther Island is intended to be a highly dense, walkable district that supports 10,000 residents as well as retail and office space.

Who's Paying for it?

Officials including U.S. Rep. Kay Granger, who has championed Panther Island, have aimed for the project to cost little for local taxpayers in the long run. But the project has used a significant amount of local money, which is slated to be repaid in the future, to get it off the ground.

Local officials have pushed the federal government to pay for the new bypass channel, because that is the flood-control portion of the project. Until recently, the project had received only $62 million in federal funds, far short of the more than $1 billion price tag for the project.

But on Wednesday, Granger’s office announced that the federal government has granted the U.S. Army Corps of Engineers $403 million in additional funding for the flood-control portion of the project.

Other entities have chipped in money as well. The Texas Department of Transportation constructed the three new bridges that will lead to the eventual Panther Island (more on that below). Other costs, such as for land acquisition and cleanup, have been fronted by the Tarrant Regional Water District, which initially loaned $200 million to the project.

What work has already been done?

So far, construction has not begun on the hallmark of the project — the digging of the 1.5-mile river channel.

But there has been some progress on other aspects.

Most notably, the Texas Department of Transportation has finished construction on three new bridges that will carry traffic over the new channel, once it’s dug. The three bridges are on White Settlement Road, North Main Street and Henderson Street. The final bridge opened to traffic in September, six years after construction for the three bridges began.

The water district has spent a considerable amount of money acquiring the properties along the planned route of the new channel. The water district also has overseen the environmental cleanup of a number of properties, which were contaminated from their past uses in manufacturing and industry. In the meantime, the city of Fort Worth has been tasked with moving and setting up utilities to accommodate the new channel.

What work needs to be done?

Right now, the Panther Island bridges span dry land. The biggest portion of the project, which has not yet begun, is the digging of the new bypass channel.

Before the actual digging can begin, officials must first finish the design and contracting for the channel. The U.S. Army Corps of Engineers, which is leading the channel construction, is about halfway done with the design of the channel, the Star-Telegram reported on Wednesday.

The Tarrant Regional Water District’s now-general manger, Dan Buhman, told the Star-Telegram over the summer that it would take eight to 10 years to complete the channel, after federal funding came through. Based on that estimate, Panther Island would not become a full island until 2030 at the earliest.

So is it a development project or a flood control project?

Local officials say that Panther Island/Central City does double-duty as a flood-control and development project. When pitching to the public and potential developers, officials highlight the vision of a bustling urban neighborhood.

When pitching the project for funding from the feds, officials highlight the need to protect the surrounding low-lying areas from floods.

At least as far back as 2005, the Star-Telegram reported that the surrounding areas could be protected with a less-costly flood control option: raising the levees that already line the river. That would’ve cost about $10 million at the time. The then-general manager of the water district, Jim Oliver, told the Star-Telegram in 2005 that the cheaper option of pure flood control would be “no frills, ugly.” The Trinity River Vision Authority opted instead for a grander plan.

Why has it taken so long?

Every step of the project’s timeline has stretched well beyond its original estimates. It’s common for public projects, particularly construction projects, to take longer than planned — but Panther Island has taken that norm to an extreme.

The vision for the current version of the Panther Island project began in the 2000s. A big reason for the delay can be attributed to the lack of federal funding, which local officials continually looked for in each federal budget cycle. During the administration of former President Donald Trump, local officials including Granger indicated that the request for federal funding was indefinitely stalled — Trump’s budget office, according to Granger, had given a hard “no” to funding for the project. But it’s not just the federal funds that have delayed Panther Island.

Even the bridge construction, which was done by the Texas Department of Transportation, was significantly delayed. When the construction of the three bridges began in 2014, the department estimated it would be completed by 2018. Construction did not wrap up until September 2021.

Why is it called panthers Island?

The Panther Island project was originally called the Trinity Uptown project, reminiscent of Dallas’ trendy Uptown neighborhood.

But the development portion was renamed Panther Island as a reference to Fort Worth’s nickname “Panther City.”

The city earned that nickname in the late 1800s, after a lawyer published a column in a Dallas newspaper claiming that Fort Worth was such a quiet city that a panther fell asleep downtown and no one noticed. Fort Worthians embraced the insult and began incorporating the panther into business names and logos. The Fort Worth Police badge featured a panther beginning in 1912, and eateries, breweries and stores across the city also sport the name.

When will we know more about the project's future?

Granger and U.S. Rep. Marc Veasey, along with officials from the city of Fort Worth and the Tarrant Regional Water District, plan to hold a press conference on the project’s federal funding on Thursday morning. That briefing is expected to yield additional information about the project and its funding, as well as give an opportunity for more questions to be answered.

News

January 27, 2022

The U.S. Army Corps of Engineers has kicked into high gear to begin work on the 1.5 mile bypass channel for Fort Worth’s Panther Island, and the city, county and water district need to act with similar speed to keep up, the project manager said Thursday. Speaking to the Trinity River Vision Authority on Thursday, Woody Frossard said his project development teams have set up meetings next week with the Corps and the city for how to move forward. Frossard works for the Tarrant Regional Water District. The board meeting comes eight days after the Army Corps announced it was allocating $403 million to construct the channel north of downtown and finish a series of man-made flood plains.

The project, first conceived in 2003, aims to bolster Fort Worth’s aging levee system built in 1960. This is the most money the agency has allocated to the project. Congress approved $526 million in 2016, but disagreements with the Trump administration over the project’s feasibility held up funding.